The global investment landscape is shifting fast. With emerging technologies reshaping markets, investors are looking beyond traditional sectors. One area gaining traction is 3D printing, and at the intersection of hype and potential sits the platform 5StarsStocks.com. This platform claims to simplify complex analysis for retail investors by offering AI-driven ratings across hot sectors—including the much-discussed 5starsstocks.com 3d printing stocks.

But is this platform offering genuine insight—or selling smoke? In this article, we dissect the strategy, stock picks, platform features, and real-world results to help you decide whether 5StarsStocks.com deserves a place in your portfolio.

What Is 5StarsStocks.com?

Launched in 2023, 5StarsStocks.com presents itself as a modern-day stock discovery tool. It uses AI models to scan market trends, investor sentiment, and financial performance, delivering star ratings for individual stocks.

Its standout feature is its focus on emerging industries, including:

- 3D Printing

- Lithium mining

- AI-powered tools

- Cannabis

- Defense tech

Rather than overwhelming users with complex charts, it simplifies things using a five-star scoring system and categorized reports. The promise? Helping new investors make smarter decisions without needing a Wall Street degree.

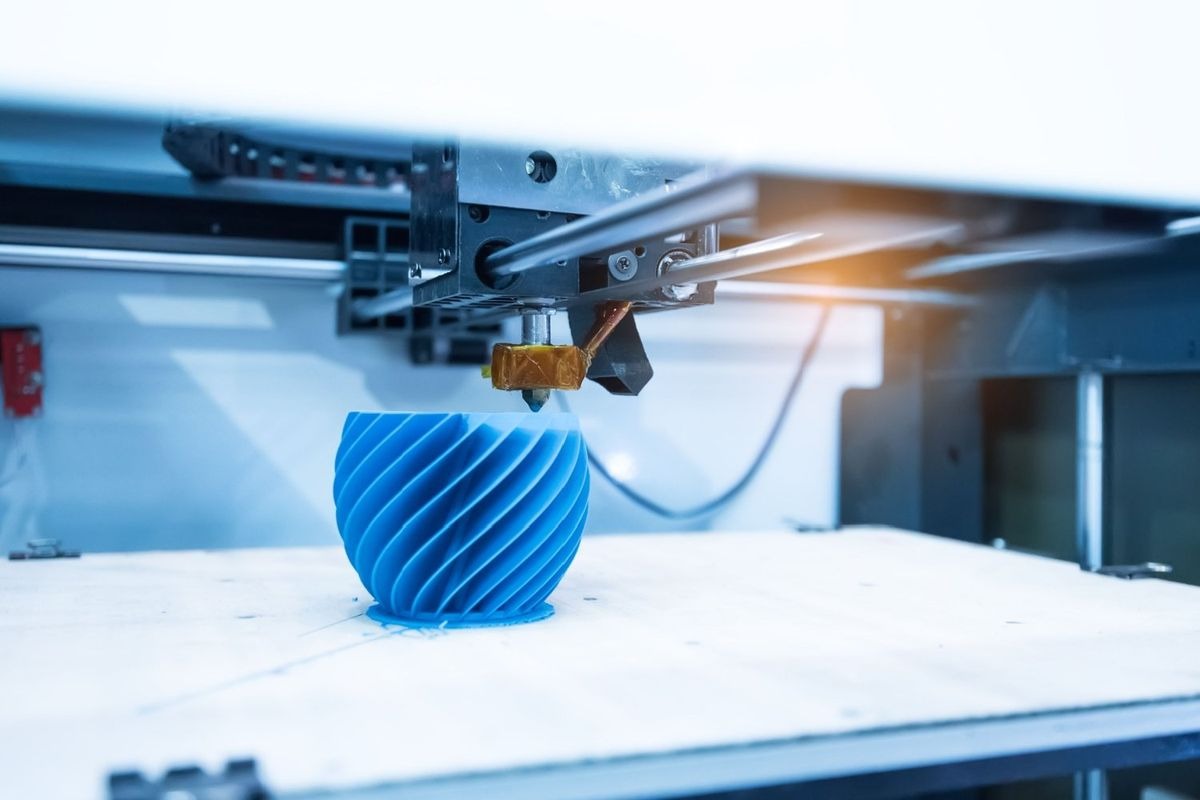

Why 3D Printing Stocks?

3D printing—also known as additive manufacturing—is reshaping everything from aerospace parts to prosthetic limbs. Investors

see this not just as a tool, but a megatrend.

Key Investment Drivers:

- Rapid prototyping and customization

- Decentralized manufacturing

- Cost-effective innovation

- Sustainability through material efficiency

Analysts estimate the 3D printing market will exceed $60 billion by 2030. But while the industry has long-term potential, it also carries significant short-term risks and volatility.

Top 3D Printing Stocks on 5StarsStocks.com

Although actual ratings may change in real time, based on the platform’s sample picks, here are three high-profile names that have consistently appeared under their 5starsstocks.com 3d printing stocks category:

| Company Name | Ticker | Sector | Rating | Highlights |

|---|---|---|---|---|

| PrintForm Technologies | PFTX | Industrial & Aerospace | ★★★★★ | Titanium powder process, strong defense contracts |

| BioLayer3D | BLD3 | Biomedical Additive Mfg | ★★★★☆ | FDA-cleared scaffolds, biotech licensing revenue |

| MakerAxis | MAXI | Consumer & B2B Printers | ★★★★☆ | Leader in desktop printing for schools & SMEs |

These companies span diverse use cases and vary in market maturity. The platform claims to assess these picks using a blend of earnings growth, innovation velocity, insider activity, and market sentiment.

Key Features That Power 5StarsStocks.com’s Strategy

Despite its flashy simplicity, the platform claims to use robust tools for evaluating emerging stocks, including those in the 3D printing sector.

Notable Features:

- AI-powered scoring: Tracks earnings trends, industry momentum, and public sentiment

- Smart alerts: Warn users of unusual volume or activity

- Real-time dashboards: Display sector performance and market heat maps

- Educational hub: Tutorials and guides for novice investors

- Sentiment analysis: Monitors platforms like Reddit and Twitter for retail buzz

While these features sound impressive, they require scrutiny, especially in volatile sectors like additive manufacturing.

The Volatility Factor in 3D Printing Stocks

3D printing stocks are notoriously volatile. Rapid innovations, uncertain supply chains, and inconsistent profitability can lead to wild stock price swings. 5StarsStocks.com attempts to manage this by offering:

- Volatility scoring

- Trailing stop notifications

- Comparison tools against sector benchmarks

But even with these tools, risks remain high—especially when star ratings may lag behind fast-moving news or earnings results.

Real-World Results: Mixed Reviews and Accuracy Gaps

The platform markets a 70% accuracy rate, but an independent 4-month test painted a different picture:

- Only 35% of recommendations were profitable

- Test portfolios lost 5.6%, while the S&P 500 gained 8.2%

- A “strong buy” 3D printing stock dropped 23% in one week after a cash burn report

On the flip side, some users have seen success—particularly with niche stocks like lithium miners and speculative biotech.

This divergence highlights a key issue: the platform might work as a discovery tool, but should not be your only compass.

Pros and Cons of 5StarsStocks.com 3D Printing Stocks

| Pros | Cons |

|---|---|

| User-friendly interface for beginners | Anonymous ownership raises trust concerns |

| Focus on hot sectors like 3D printing & lithium | Actual accuracy may fall short of marketing claims |

| Simplified 5-star rating system | Pushy upselling and lack of clear disclaimers |

| Sentiment tracking across social platforms | No integration with regulated brokerages or APIs |

| Educational resources for first-time investors | High-risk stock alerts can mislead inexperienced users |

Who Should Use This Platform?

5StarsStocks.com appeals most to:

- New investors learning how to read stock trends

- Retail traders looking for early-stage picks

- Curious researchers interested in alternative data

However, seasoned investors and analysts may find its depth limited compared to platforms like Morningstar, Zacks, or E*TRADE.

What to Watch Before Trusting Any “5-Star” Rating

Before buying into 5starsstocks.com 3d printing stocks, make sure you:

- Double-check financials from other sources

- Track insider trades and news independently

- Avoid blindly following “Buy Now” alerts

- Understand your risk appetite and timeline

- Remember that AI ratings are not foolproof

Conclusion: The Promise and Pitfalls of 5StarsStocks.com

The platform provides an engaging way to discover high-potential stocks in fast-growing sectors like 3D printing. But it’s not a shortcut to guaranteed returns.

For beginners, it can be a great starting point. For experienced traders, it may serve as one layer in a broader research stack. Either way, the real power lies not in star ratings—but in how you interpret them.

Approach it as a tool, not a solution. Be skeptical, stay informed, and use critical thinking to filter the noise from the narrative.

FAQs

Q1. What is 5StarsStocks.com and how does it evaluate 3D printing stocks?

It’s a stock discovery platform that uses AI algorithms and sentiment tracking to rate emerging stocks—especially in sectors like 3D printing.

Q2. Are 3D printing stocks safe to invest in through 5StarsStocks.com?

These stocks offer long-term promise but are highly volatile. Use the platform’s tools cautiously and verify data before investing.

Q3. What are the top-rated 3D printing stocks on the platform?

Examples include PrintForm Technologies (PFTX), BioLayer3D (BLD3), and MakerAxis (MAXI), but ratings may change over time.

Q4. How reliable is 5StarsStocks.com?

It offers useful features but has transparency and accuracy issues. Treat it as a research supplement, not a sole decision-maker.

Q5. Who benefits most from 5StarsStocks.com?

Beginner to intermediate investors exploring emerging tech sectors like 3D printing, who are willing to cross-check recommendations.